Hakkımızda

Exhibit

+

Etkinliklerinizi Dijitalde Yönetin!

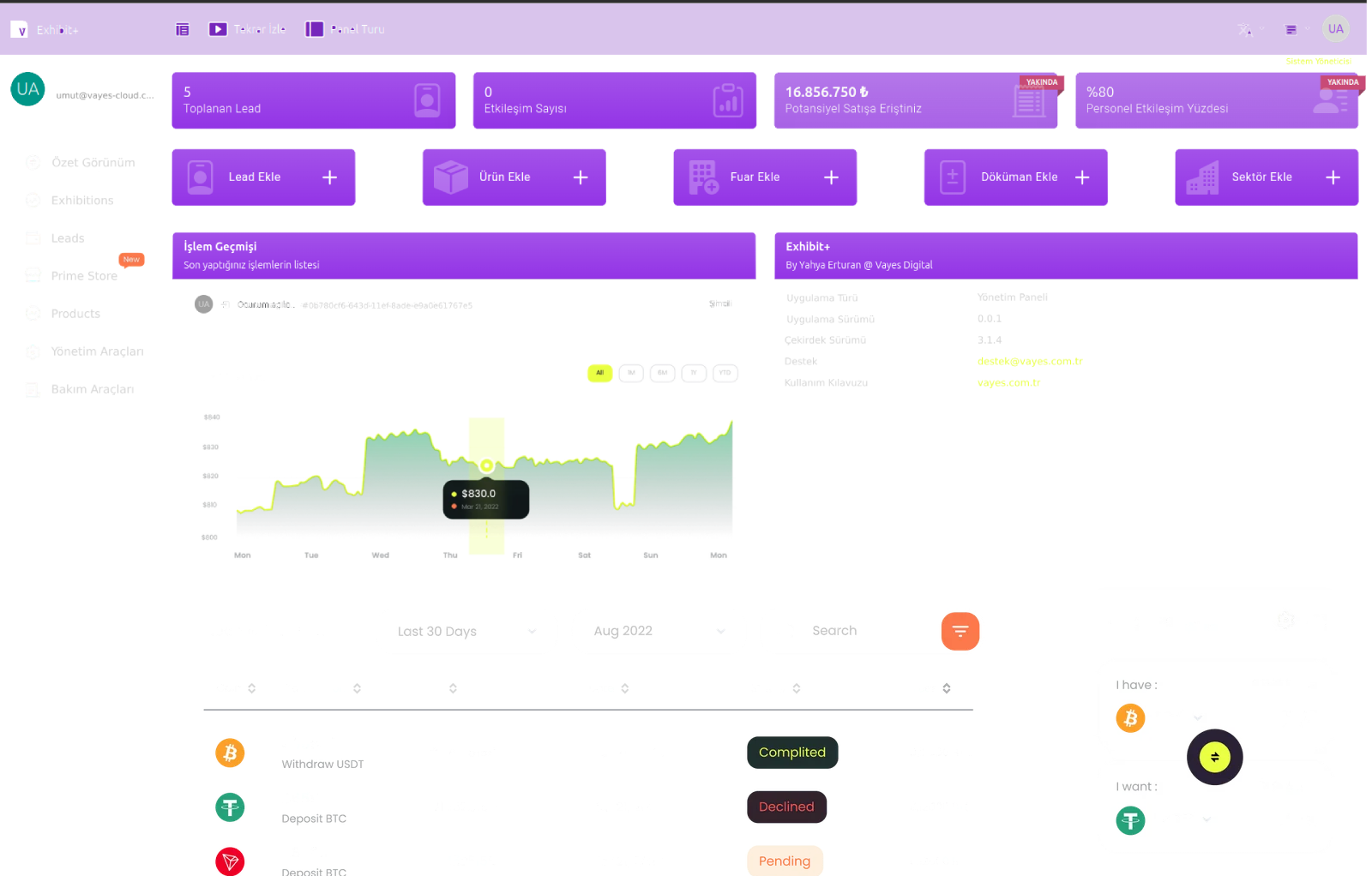

Exhibit +: Etkinlik Yönetiminde Devrim!

-

Fuar Başarılarınızı Bir Adım Öteye Taşıyın!

Exhibit+ ile fuar yönetimini daha akıllı, verimli ve etkili hale getirin. Katılımcılarla güçlü bağlar kurun, verileri anlık yönetin ve etkinliklerinizi maksimum başarıyla tamamlayın!

-

Fuar Alanındaki Karmaşayı Kolaylıkla Aşın!

Exhibit +, fuar alanındaki karmaşayı ortadan kaldırarak etkinliklerinizi sorunsuz bir şekilde yönetmenizi sağlar. Katılımcı kayıtlarından ürün tanıtımlarına kadar her adımda düzeni sağlar, bilgi akışını hızlandırır. -

Yüksek Başarı Oranı

Exhibit +, etkinlik yönetiminde yüksek başarı oranıyla dikkat çeker. Akıllı analiz araçlarımız ve kullanıcı odaklı çözümlerimiz sayesinde, her etkinliğinizi hedeflerinize ulaşmak için optimize ediyoruz. Katılımcı geri bildirimlerini gerçek zamanlı olarak değerlendirerek sürekli gelişim sağlıyor ve etkinliklerinizin her aşamasında maksimum verim elde etmenizi garanti ediyoruz. Yüksek başarı oranı ile Exhibit +, etkinliklerinizi unutulmaz kılar! -

Stratejik Lead Yönetimi

Exhibit +, stratejik katılımcı ve lead yönetimi ile etkinliklerinizi bir adım öne taşır. Akıllı lead yönetim araçlarımız sayesinde potansiyel müşterilerinizi etkili bir şekilde takip edebilir, ihtiyaçlarına göre özelleştirilmiş iletişim stratejileri geliştirebilirsiniz. Katılımcı verilerini analiz ederek, hangi segmentlerin etkinliğinizden en fazla faydalandığını belirler ve onlara yönelik stratejik planlamalar yaparsınız. Exhibit + ile her lead, değerli bir fırsata dönüşür; etkinliklerinizde başarıyı artırmak için gereken tüm kaynaklara sahip olun!

Neden Bizi Seçmelisiniz?

-

Kullanıcı Dostu Arayüz

Etkinliklerinizi kolayca yönetmek için tasarlanmış, sezgisel bir arayüz sunuyoruz. -

Gerçek Zamanlı Analiz

Katılımcı verilerini anlık olarak takip edin ve stratejik kararlarınızı hızlıca alın. -

Yüksek Güvenlik Standartları

Verilerinizi korumak için en üst düzey güvenlik protokollerini kullanıyoruz.

Hedeflerinize Bir Adım Daha Yaklaşın, Başarıyı Birlikte Yakalayın ve Etkinliklerinizi Unutulmaz Kılın!

Lorem Ipsum

input-

Institutional

Trading AccountWelcome to our specialized institutional trading account, meticulously crafted for large financial institutions, hedge funds, and professional traders. Unlock a world of tailored benefits designed to meet the unique demands of high-volume trading.Institutional Trading Account

Our institutional trading account is a specialized account designed for large financial institutions, hedge funds, and other professional traders. This account type offers a wide range of benefits that are tailored to the needs of these high-volume traders.

One of the key benefits of our institutional trading account is the access to deep liquidity and tight bid-ask spreads. This is due to the large trading volumes that these accounts handle, which allows the institutions to negotiate better trading conditions with the broker.

Another benefit of our institutional trading account is the ability to trade with high leverage, this allows the institutions to maximize their returns on investment, as well as execute trades of large amounts with relatively low capital.Additionally, institutional trading accounts offer a high level of customization, these accounts can be tailored to the specific needs of the institution, such as the ability to integrate with their own trading systems, or the ability to execute large block trades. This level of customization allows institutions to optimize their trading operations, and gain a competitive edge in the market.

Institutional trading accounts also offer a higher level of security and compliance, financial institutions are subject to strict regulations, and our institutional trading account is fully compliant with all the relevant regulations such as the Financial Conduct Authority (FCA) and the SEC.

Overall, our institutional trading account is a powerful tool for large financial institutions, hedge funds, and other professional traders, offering deep liquidity, high leverage, customization, and a high level of compliance, allowing the institution to optimize their trading operations and gain a competitive edge in the market. -

What is required to execute HFT?

High-Frequency Trading (HFT) requires specialized hardware to execute trades at extremely high speeds. The hardware used for HFT includesWhat is required to execute HFT?

High-Frequency Trading (HFT) requires specialized hardware to execute trades at extremely high speeds. The hardware used for HFT includes:

- High-Performance Super Computers: HFT requires powerful computers with multiple processors to analyze market data and execute trades in real-time. These computers typically use specialized chips, such as FPGAs or ASICs, which are optimized for high-speed data processing.

- Low-Latency Networking: HFT requires low-latency networks that can transmit data between the exchange and the trading firm's computers in milliseconds. This is typically achieved through the use of specialized networking hardware such as switches, routers, and fiber-optic cables.

- Data Storage: HFT requires large amounts of storage to store historical market data, which is used to train the algorithm. These storage solutions typically use SSDs or other fast storage technologies to ensure high-speed data access.

- Cooling Systems: HFT hardware generates a lot of heat, so specialized cooling systems are required to keep the hardware running at optimal temperatures.

- Software: HFT requires specialized software to analyze market data and execute trades. This software typically includes trading platforms, risk management systems, and algorithms.

In addition to the hardware and software, HFT also requires specialized knowledge and expertise to design and implement the systems, manage and maintain them, and continuously improve the algorithm and strategies used for trading. This expertise typically includes knowledge of market data analysis, software development, networking, and system administration.

It's important to note that HFT requires significant investments in hardware, software, and personnel, and it's also important to be aware of the regulations and laws of the countries where the trading is conducted.

-

Why isn’t everyone doing HFT?

High-Frequency Trading (HFT) is a complex and capital-intensive activity that requires significant investments in specialized hardware, software, and personnel. Not everyone is able to make these investments, and as a result, HFT is typically only done by large financial institutions and hedge funds.Why isn’t everyone doing HFT?

High-Frequency Trading (HFT) is a complex and capital-intensive activity that requires significant investments in specialized hardware, software, and personnel. Not everyone is able to make these investments, and as a result, HFT is typically only done by large financial institutions and hedge funds.

Another reason is that HFT requires specialized knowledge and expertise to design and implement the systems, manage and maintain them, and continuously improve the algorithm and strategies used for trading. Not everyone has the expertise or resources to develop and maintain an HFT operation.

Additionally, HFT is a high-risk activity, with the potential for large profits but also large losses. The high-speed and high-volume nature of HFT can also increase the risk of market disruptions and flash crashes.

Finally, regulations and laws of different countries play a big role in the prevalence of HFT. In some countries, HFT is heavily regulated and restricted, making it difficult or impossible for firms to engage in this activity.

Therefore, the combination of high costs, specialized knowledge and expertise, high-risk and compliance with laws and regulations are some of the reasons why not everyone is doing HFT.